Image 1 of 5

Image 1 of 5

Image 2 of 5

Image 2 of 5

Image 3 of 5

Image 3 of 5

Image 4 of 5

Image 4 of 5

Image 5 of 5

Image 5 of 5

Mileage/Vehicle Expense tracker

Our Mileage and Vehicle Expense Tracker Template is designed to simplify the process of tracking your business-related travel expenses and ensure you maximize your tax deductions. This comprehensive tool helps you accurately record mileage, vehicle costs, and other related expenses, making it easier to manage and optimize your travel expenses.

Our Mileage and Vehicle Expense Tracker Template is designed to simplify the process of tracking your business-related travel expenses and ensure you maximize your tax deductions. This comprehensive tool helps you accurately record mileage, vehicle costs, and other related expenses, making it easier to manage and optimize your travel expenses.

Our Mileage and Vehicle Expense Tracker Template is designed to simplify the process of tracking your business-related travel expenses and ensure you maximize your tax deductions. This comprehensive tool helps you accurately record mileage, vehicle costs, and other related expenses, making it easier to manage and optimize your travel expenses.

Here’s what’s included:

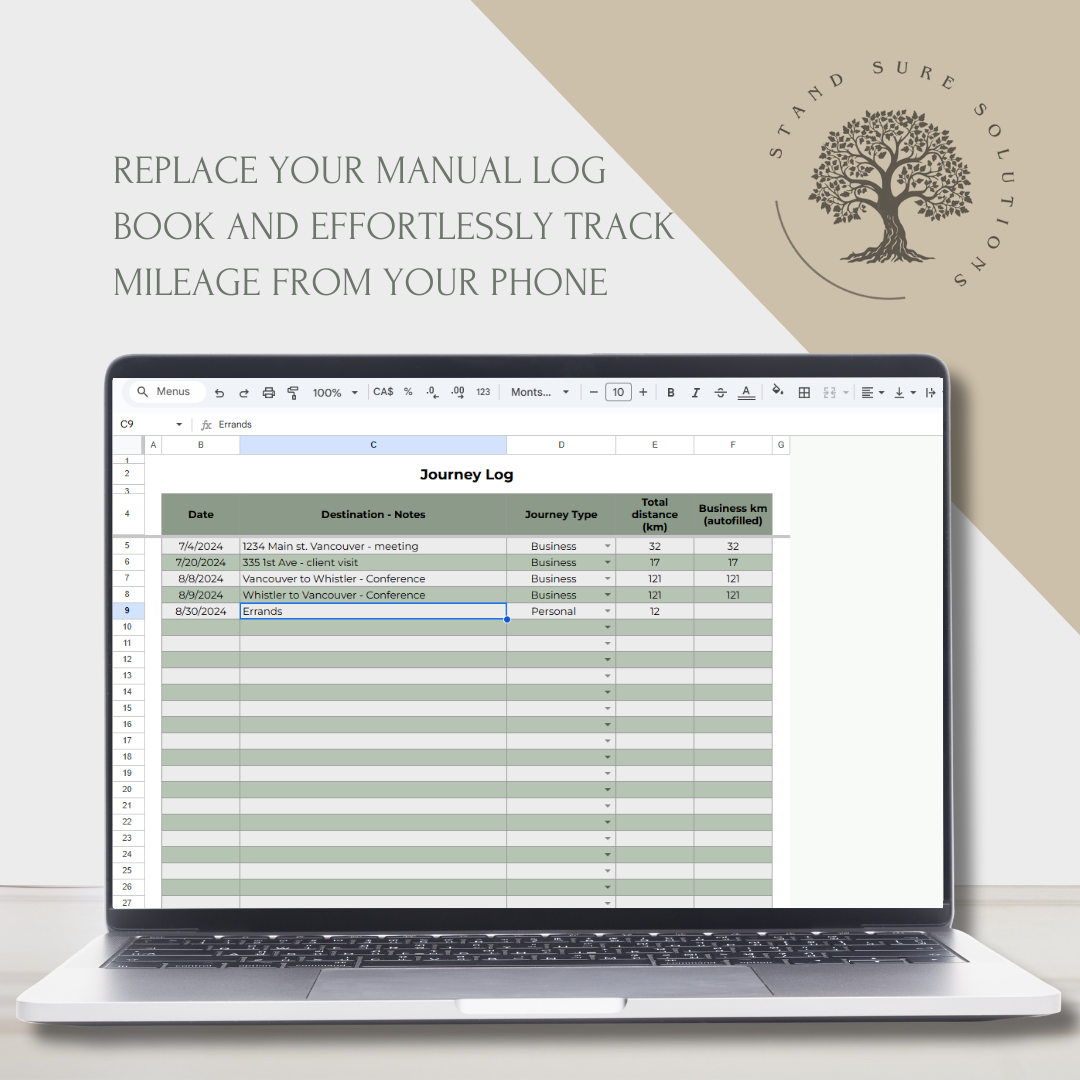

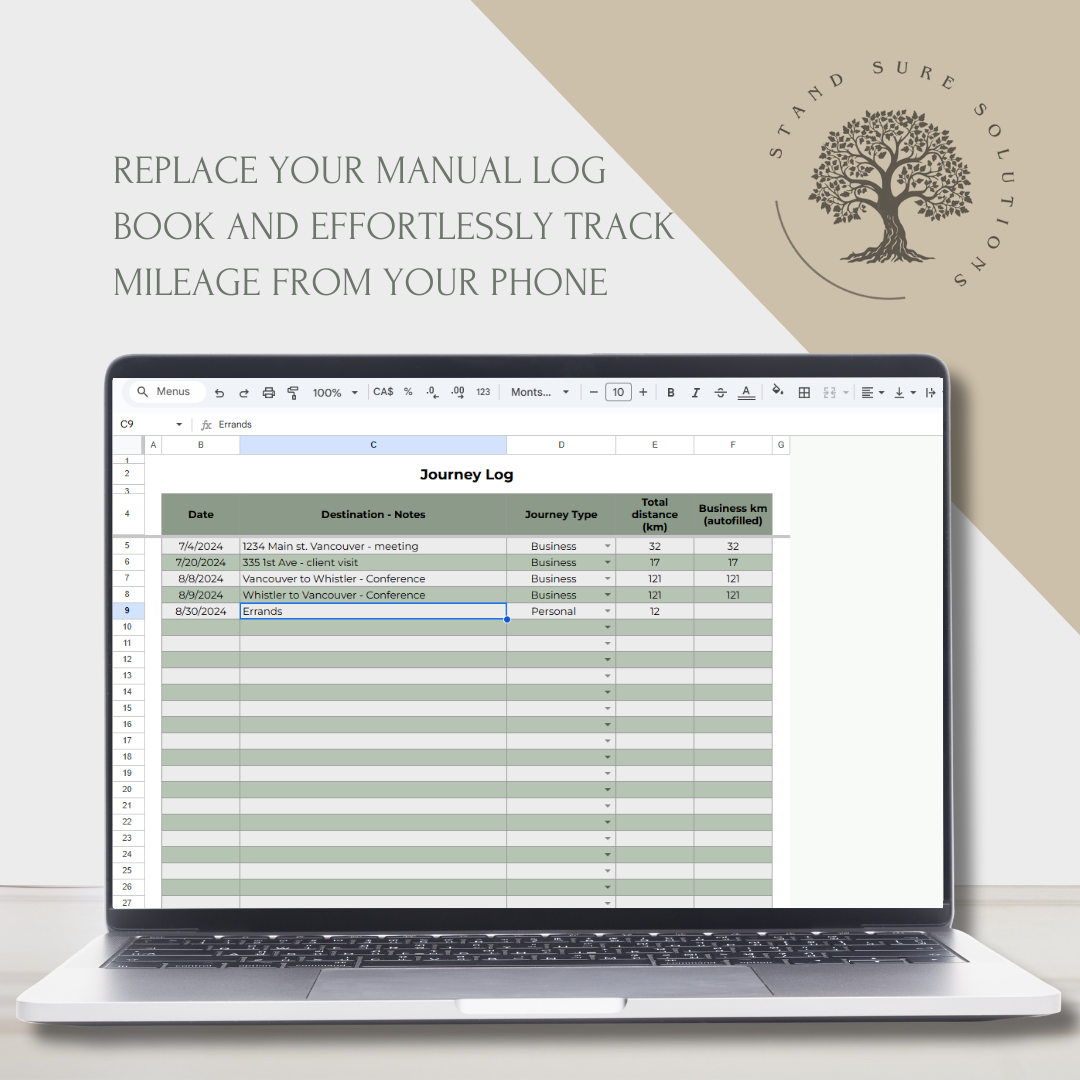

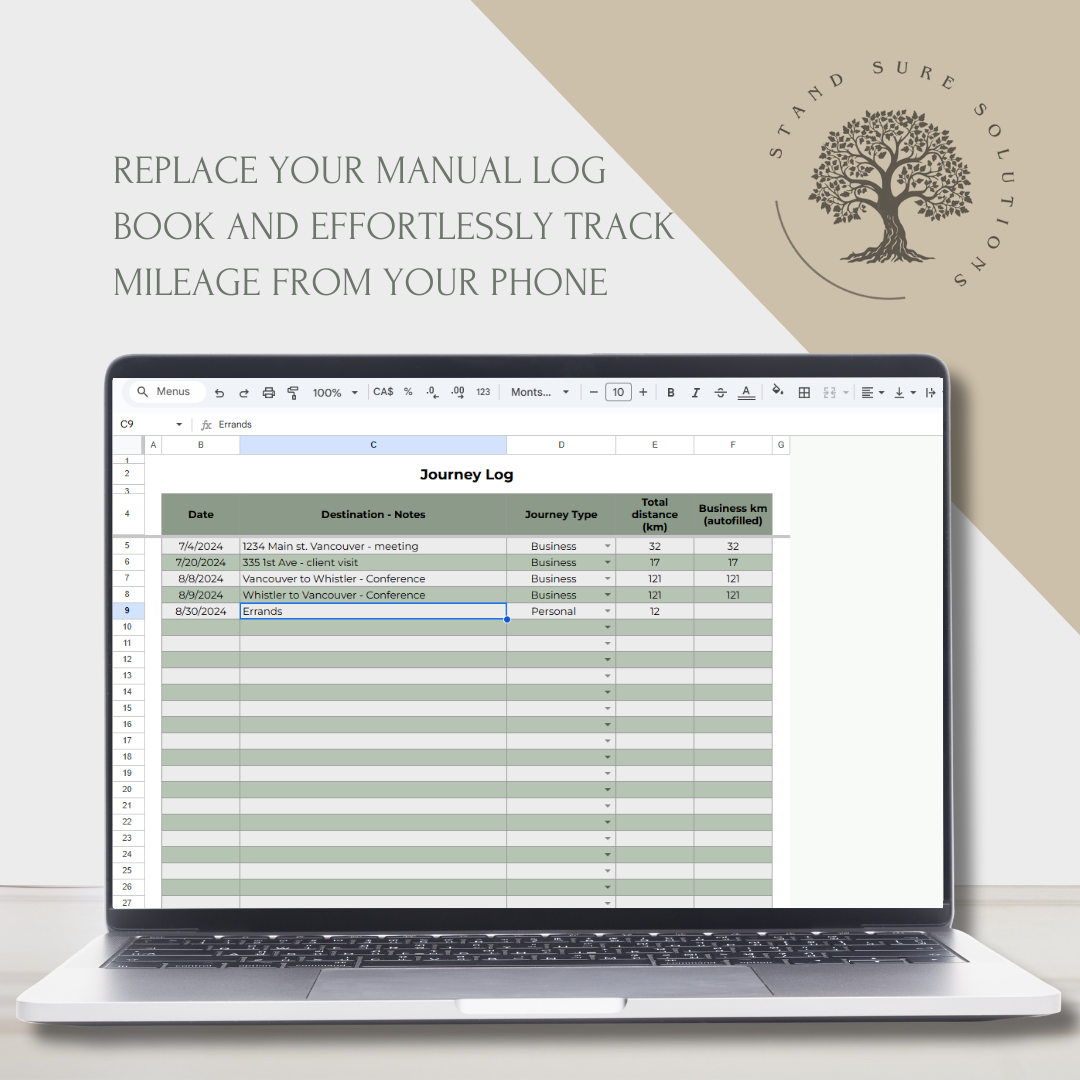

1. Mileage Tracking

Simple Mileage Logs: Easily record the date, purpose, start and end locations, and total kilometers driven for each trip. This section is designed to make logging your mileage quick and straightforward, whether you’re tracking daily commutes, client visits, or other business travel.

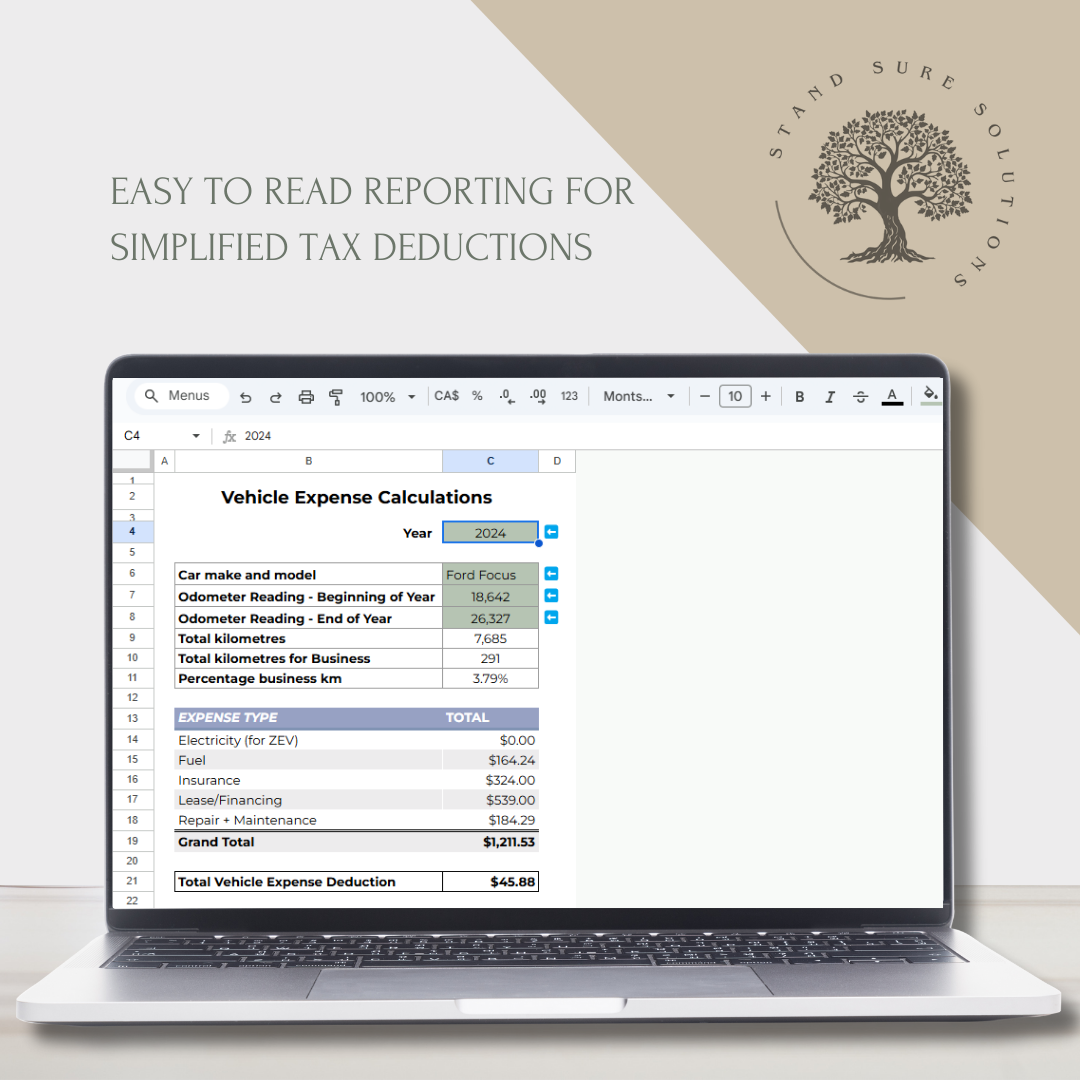

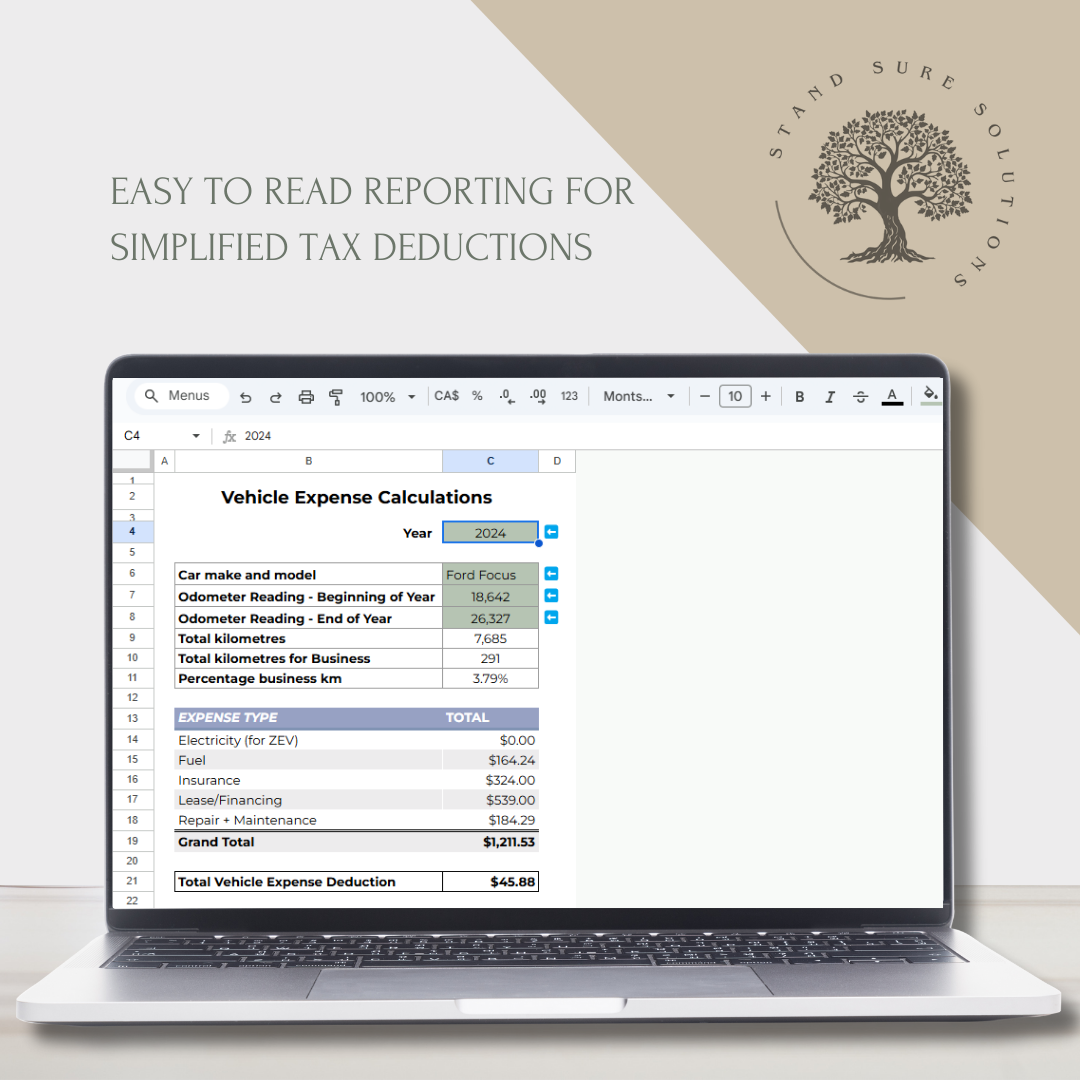

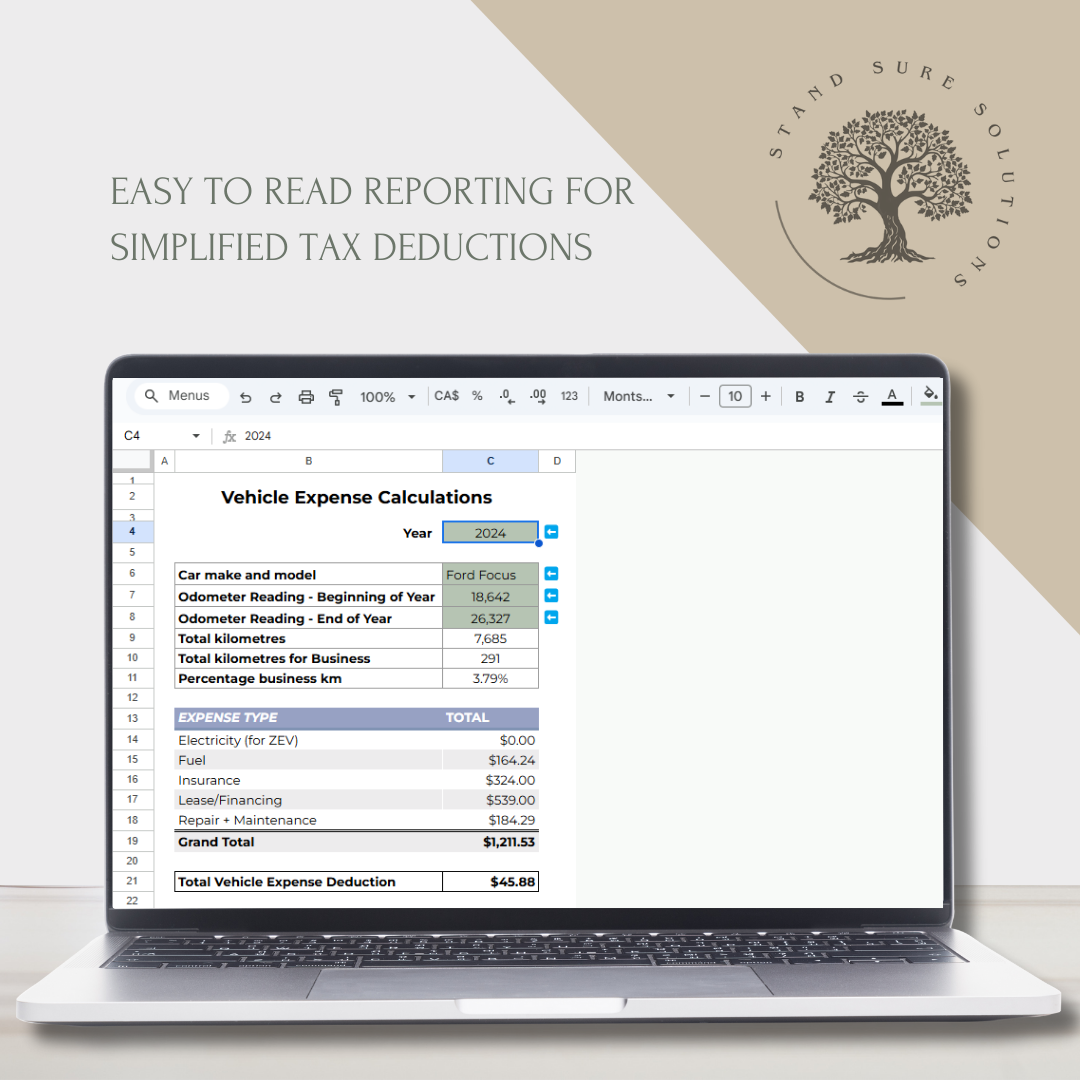

2. Vehicle Expense Tracking

Detailed Expense Entries: Track all your vehicle-related expenses, including fuel, maintenance, repairs, insurance, registration fees, and lease or loan payments. This allows for a complete view of your total vehicle costs over time.

3. Expense Summary and Reports

Monthly and Annual Summaries: View your total mileage and expenses on a monthly and yearly basis. The template provides summaries that consolidate all your entries, giving you a clear snapshot of your vehicle costs and usage.

Tax Deduction Reports: Generate reports that outline your total deductible amounts, helping you prepare for tax season with confidence and ensuring you maximize your eligible deductions.

4. Compliance and Record-Keeping

Comprehensive Records: Maintain all your vehicle and mileage records in one place, making it easier to comply with tax requirements and providing a reliable backup in case of an audit.

Printable Reports: Export or print reports directly from the template for easy sharing with your accountant or tax preparer, ensuring you have all the necessary documentation at your fingertips.

Return Policy - At Stand Sure Solutions, we are committed to providing high-quality digital products to support your business and personal needs. Due to the nature of our products (digital downloads and templates), all sales are final. We do not offer refunds or exchanges once a digital product is purchased and delivered. We recommend reviewing product descriptions and details carefully before purchase.